The DAX Futures is trading at 12,777.50 up with +0.18% percent or +23.00 point .The FTSE 100 Futures is trading at 7,695.50 up with +0.21% percent or +16.50 point. The CAC 40 Futures is trading at 5,450.22 for up with +0.034% percent or +1.87 point . The EURO Stoxx 50 Futures is trading at 3,454.00 up with +0.41% percent or +14.00 point.

TODAY’S FACTORS AND EVENTS

Next week we have the ECB meeting, which could be pivotal as the central bank is expected to discuss a timeline for the removal of its easy monetary stance. While this is expected, the degree of hawkishness expressed by the central bank could be telling for the DAX. Expect more volatility out of the euro, though, but in return depending on how outsized the move is in the single-currency, the DAX may react in opposite fashion despite the recently strong negative correlation turning positive on a month-over-month basis.

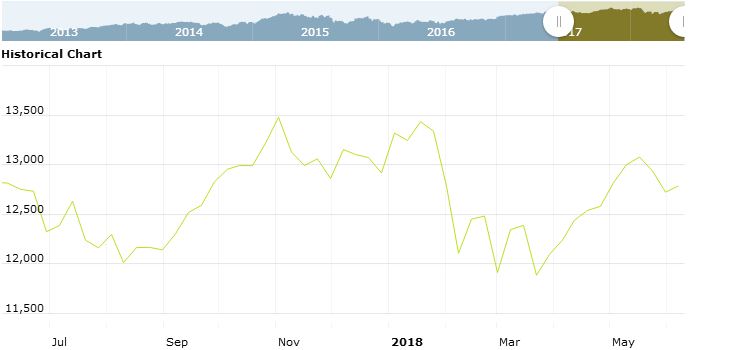

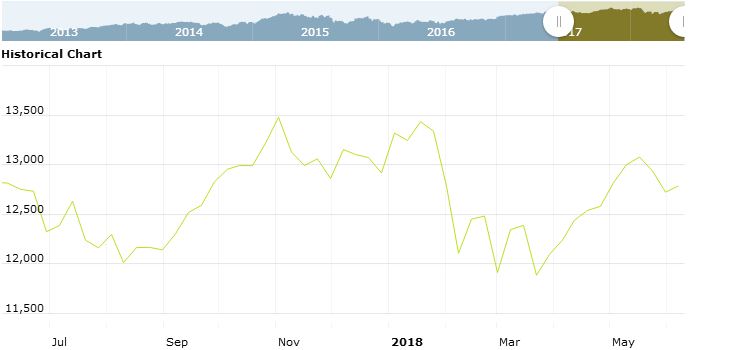

The DAX turned down last week from an area of resistance surrounding 12900, but then found support late-week near 12600, which has both price and trend-line support running through it. The market is becoming generally difficult to read at this juncture, and until we see more clarity, standing aside for the moment (outside of maybe day-trades) looks to be a prudent approach.

WORLD MARKETS

For the day the Dow is trading at 25,316.53 up with +0.30% percent or +75.12 point. The S&P 500 is trading at 2,779.03 up with +0.31% percent or +8.66 point. The Nasdaq Composite is trading at 7,645.51 up with +0.14% percent or +10.44 point.

In other parts of world, Japan’s Nikkei 225 is trading at 22,804.04 up with +0.48% percent or +109.54 point. Hong Kong’s Hang Seng is trading at 31,046.63 up with +0.29% percent or +88.42 point. China’s Shanghai Composite is trading at 3,043.51 with a loss of 0.77% percent or –23.64 point. India’s BSE Sensex is trading at 35,614.05 up with +0.48% percent or +169.58 point at 12:15 PM.