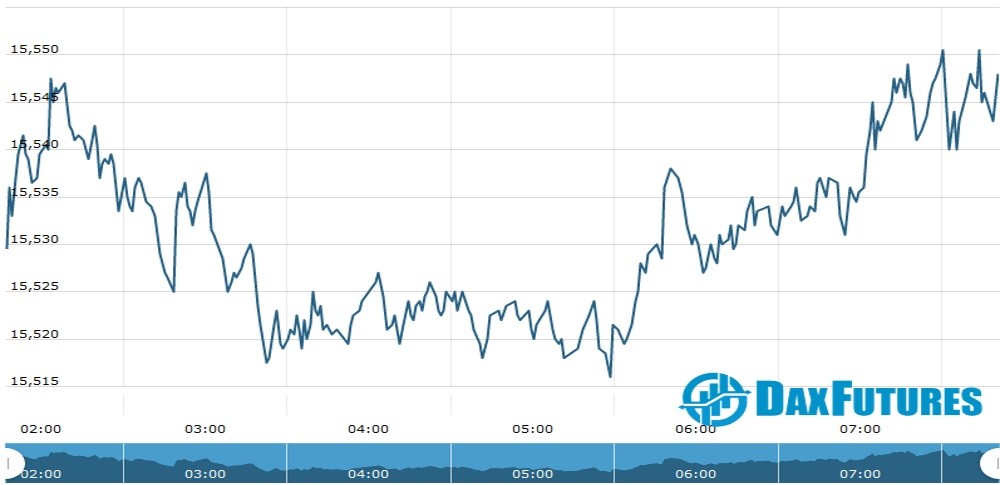

The DAX Futures is trading at 15,545.50 with a loss of -0.06% or -9.00 point. The FTSE 100 Futures is trading at 7,008.20 with +0.07% percent or +4.70 point. The CAC 40 Futures is trading at 6,564.50 with a loss of -0.82% percent or -54.00 point. The EURO Stoxx 50 Futures trading at 4,083.00 up with +0.17% percent or +7.00 point.

TODAY’S FACTORS AND EVENTS

Germany’s 10-year Bund yield hovered around -0.16% at the end of June, remaining close to a one-month high of -0.146% hit last week, as ECB officials continued to signal there is no hurry to taper the central bank’s massive emergency stimulus. ECB President Christine Lagarde reiterated that it was not yet time to allow interest rates to rise and that a tightening of wider financing conditions would be premature and would pose a risk to the ongoing economic recovery and the outlook for inflation. Elsewhere, US Federal Reserve Chair Jerome Powell said that the recent spike in prices had been bigger than expected but would likely to be temporary, and that the central bank would not raise interest rates until there are signs of a solid economic recovery.

YESTERDAY ACTIVITY

For the day Germany’s DAX closed at 15,554.18 with a loss of – percent or –53.79 point.the FTSE 100 closed at 7,072.97 with a loss of –percent or –63.10 point. France’s CAC 40 closed at 6,558.02 with a loss of – percent or –64.85 point.

WORLD MARKETS

For the day the Dow is trading at 34,283.27 with a loss of –percent or ?150.57 point. The S&P 500 is trading at 4,290.61 up with + percent or +9.91 point. The Nasdaq Composite is trading at 14,500.51 up with percent or +140.12 point.

In other parts of world, Japan’s Nikkei 225 is trading at 28,778.23 with a loss of – percent or –269.79 point. Hong Kong’s Hang Seng is trading at 29,037.36 with a loss of – percent or –230.94 point. China’s Shanghai Composite is trading at 3,576.74 with a loss of –percent or ?29.64 point. India’s BSE Sensex is trading at 52,619.90 with a loss of – percent or –115.69 point at 12:15 PM.